Texas Instruments: A Beauty Of A Quarter (NASDAQ:TXN)

SweetBunFactory

Introduction

Texas Instruments Incorporated (NASDAQ:TXN) reported its Q2 earnings yesterday, and the company knocked it out of the park. Management had indeed been “conservative” with guidance in Q1, but what the company posted beat the most optimistic analyst projections. This fortifies our belief that Texas Instruments is an exceptional company. We hope to be shareholders for a long time and expect some ebbs and flows along the way.

Without further ado, let’s dig directly into the numbers!

The numbers

The headline results

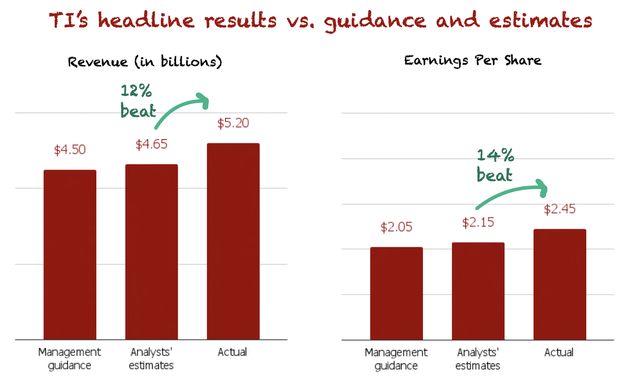

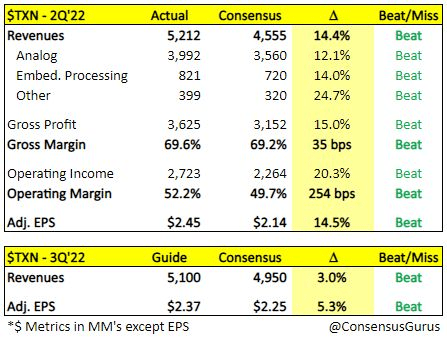

Texas Instruments surprised to the upside and beat estimates (both its own and analysts’) by a considerable margin.

Revenue came in at $5.2 billion (+14% Y/Y), beating analyst estimates of $4.65 billion or almost 12%. EPS came in at $2.45, beating estimates of $2.15, almost 14%. Impressive!

Made by Best Anchor Stocks

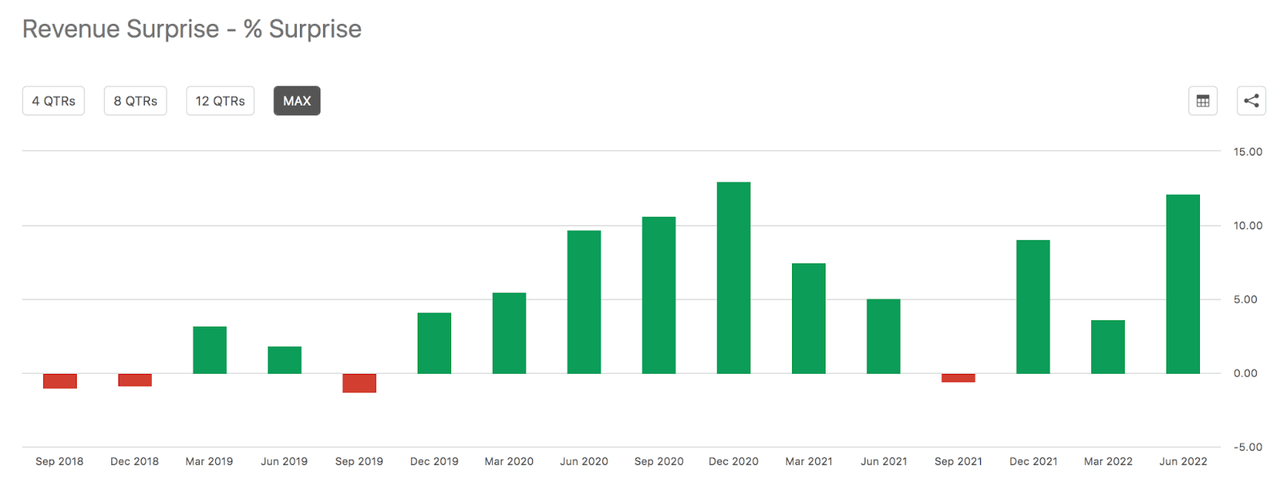

If we look at the previous quarters, we see that Texas Instruments has a history of big beats. The company has beaten revenue estimates by more than 5% in 7 out of the last 16 quarters, which is pretty impressive.

Seeking Alpha

Why does this happen? There are at least two answers to this question:

-

Analysts are not good at estimating the company’s results

-

Management is very conservative

While we think it’s a combination of both, we believe that #1 is highly influenced by #2, so it all comes back to management’s conservativeness. Of course, we prefer management teams that under-promise and over-deliver to management teams that overpromise and under-deliver. Investing involves expectations, and managing expectations in the market is crucial to protect shareholders from extreme volatility.

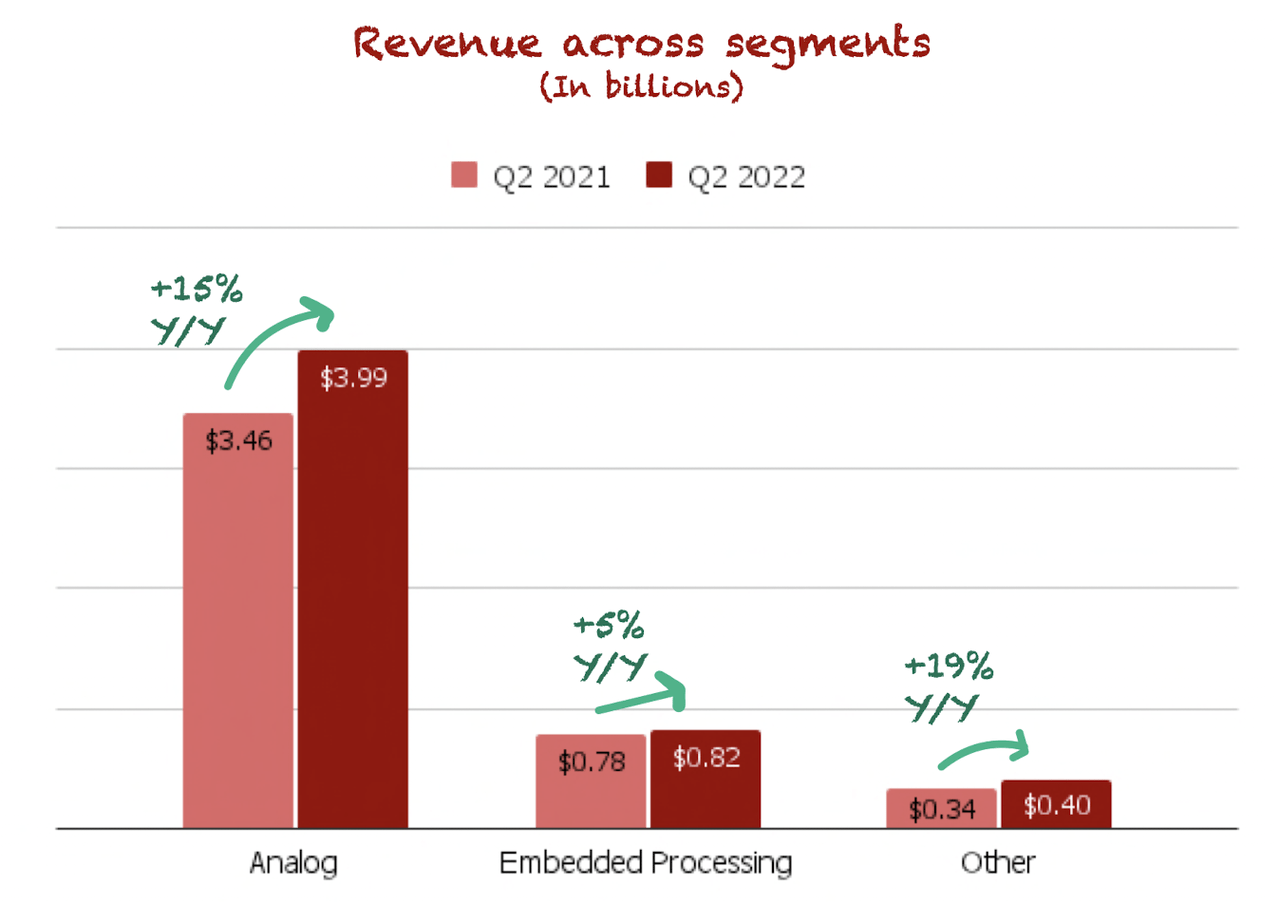

Breaking down sales across segments

If we look at how sales were distributed across segments, we see that management’s decision to focus on analog seems to be playing out quite well. Analog grew at a pretty fast pace despite its scale:

Made by Best Anchor Stocks

Inventories, demand health and outlook

As we repeated several times when we went over ASML’s Q2 earnings, when it comes to semiconductors, the focus of this earnings season is more on the demand outlook than the results themselves. With many people claiming that we are going into a severe semiconductor downcycle, semiconductor stocks have reacted in advance. Now, the numbers must prove if they overreacted or if there’s still further room to fall.

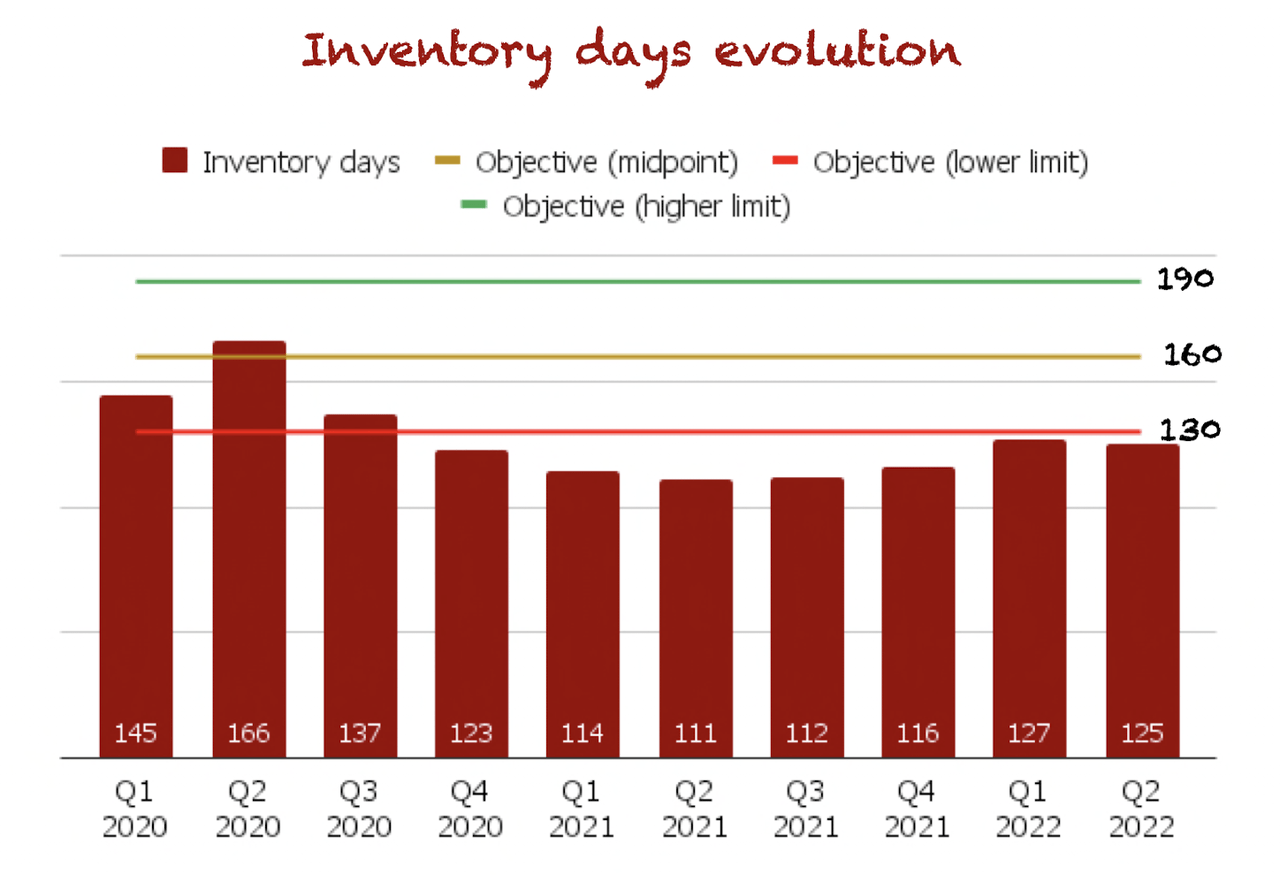

One way to measure TI’s demand health is to look at inventory days. If inventory days are increasing significantly, products are piling up because supply is outpacing demand. While we were not worried about the health of demand for ASML Holding N.V. (ASML) due to its massive order book, we thought the overall demand landscape would impact Texas Instruments more. We were wrong, and happy to be wrong.

Inventory days for Texas Instruments came in at 125, down two days sequentially and significantly below management’s objective:

Made by Best Anchor Stocks

Management has said several times that they would not feel uncomfortable if inventories were even higher than 190 days:

Our objective inventory, as you know, is to maintain high levels of customer service and roughly our target is 130 to 190 days, but we want to be at the high end of that, and we would not be uncomfortable even above the high end of that range.

Source: Rafael Lizardi (TI CFO) during Q1 2022 Earnings Call

The rationale behind management’s target is relatively straightforward: they feel the benefits of more inventory days (shorter lead times and thus better customer experience) clearly outweigh the downside of holding more inventory (higher costs).

So, not only is TI not having current demand problems, but it’s also struggling to build inventory to desired levels. This means that if a semiconductor downcycle were to materialize, management would take advantage of this “opportunity” to operate at full capacity and build inventory (emphasis added):

We’ve long believed that owning and controlling our inventory is really a strategic advantage. We finished the quarter with just a little over $2 billion of inventory. So whenever things do weaken, we’ll take that time to replenish inventories that will keep lead times stable and low.

Source: Dave Pahl (Head of IR) during Q2 2022 Earnings Call

The company already followed this strategy during the pandemic, and the result was great. While the competition stopped producing, Texas Instruments kept building its inventory. Once demand recovered, Texas Instruments was able to serve customers better (with lower lead times), helping the company gain market share and take advantage of booming demand. Remember that there’s always a boom after a bust, and those who plan for the boom will directly benefit. We believe Texas Instruments is in this group.

Another way of analyzing the demand outlook is through management’s comments. According to Texas Instruments’ management, customers are not canceling or rescheduling orders, and lead times have not changed much. The company is still operating in a “shortage” environment where demand exceeds supply.

Despite the overall strong demand, management did say they saw weakness in the personal electronics segment:

We saw weakness throughout the quarter in personal electronics, which grew low-single digits.

Source: Dave Pahl (Head of IR) during Q2 2022 Earnings Call

However, due to Texas Instruments’ diversified nature across industries, other segments were able to counter this weaker demand. Automotive was very strong (coherent with ASML’s comments on the strength of this market), and the rest of industries were up nicely too:

The industrial market was up high-single digits and the automotive market was up more than 20%. Communications equipment was up about 25%. Finally, enterprise systems was up mid-teens.

Source: Dave Pahl (Head of IR) during Q2 2022 Earnings Call

The good thing about analog semiconductors is that they are used in almost any industry shifting to digitization, which helps Texas Instruments remain diversified as it grows.

All in all, the demand health and outlook remain strong. If a semiconductor bust were to come, we believe Texas Instruments would even take advantage of this to build its inventory and come out stronger (just as the company did during the pandemic).

Breaking down profitability – Depreciation weighing into sequential margins

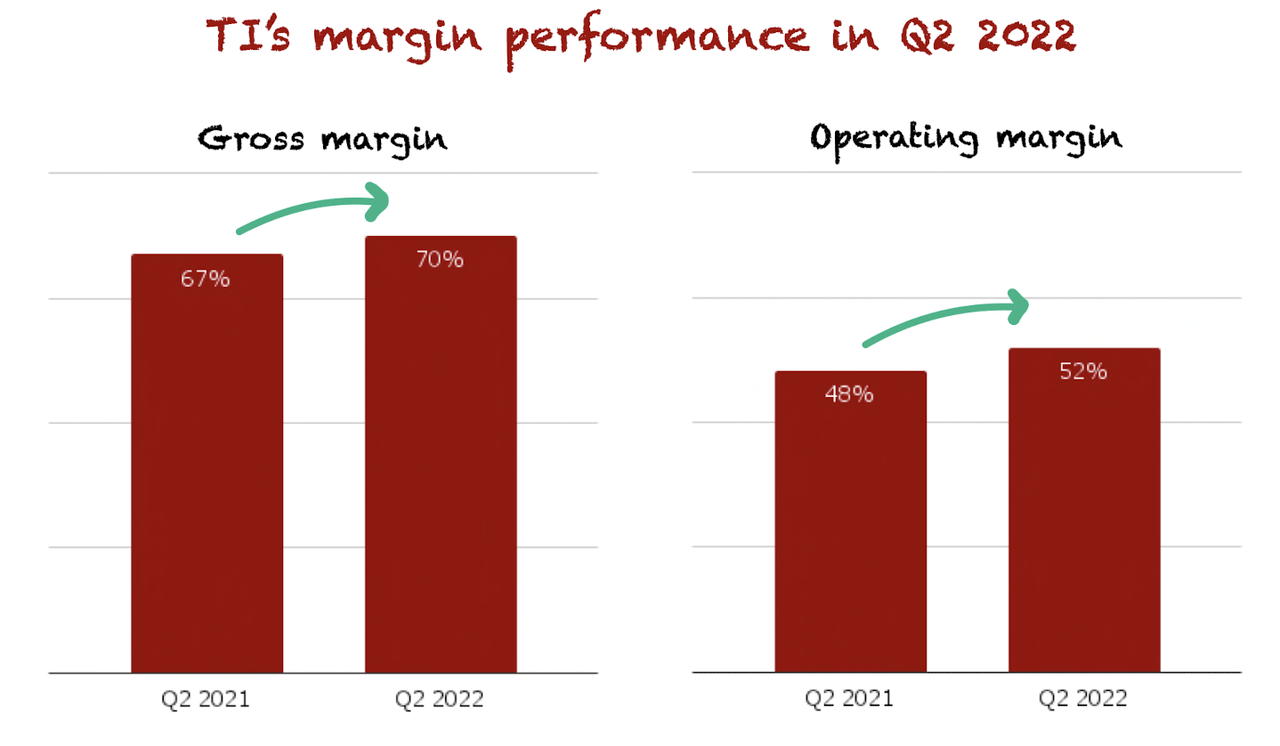

Margins for the quarter were strong. Gross Margins came in at 70%, a 240 basis points increase compared to Q2 2021. Operating profit margins also expanded and came in at 52%:

Made by Best Anchor Stocks

Gross margin suffered a sequential decrease, but a timing problem caused this. As the company builds capacity, it’s already taking some depreciation, but it’s still not reaping the benefits of this because the capacity is not yet online. This will weigh negatively on margins over the short to medium term.

EPS grew faster than revenue (+19.5% Y/Y) to $2.45. Stronger growth came from margin expansion (as discussed) and a slightly reduced share count. Diluted share outstanding decreased from 937 million in Q2 2021 to 930 million in Q2 2022.

Cash Flows Need Context

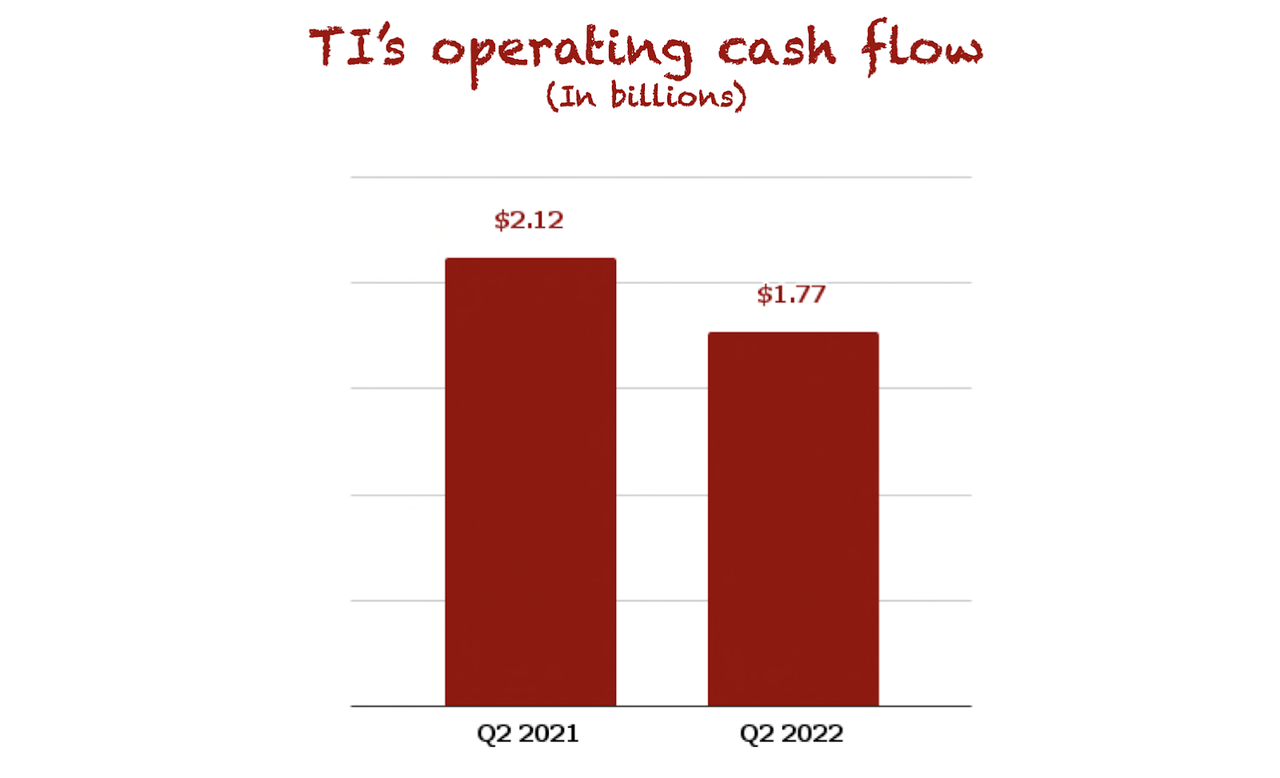

Cash flow from operations came in at $1.8 billion, a 16% decrease compared to the same quarter last year:

Made by Best Anchor Stocks

The decrease came primarily from 4 sources:

-

Higher account receivables

-

Higher inventory balance

-

Higher taxes

-

Non-recurring costs

We already talked about #2 and we should expect this to continue weighing on cash flow until the company achieves its desired inventory levels. #3 and #4 are not really worth talking about because there’s little the company can do about #3, and #4 is non-recurring in nature. However, we do want to talk briefly about #1.

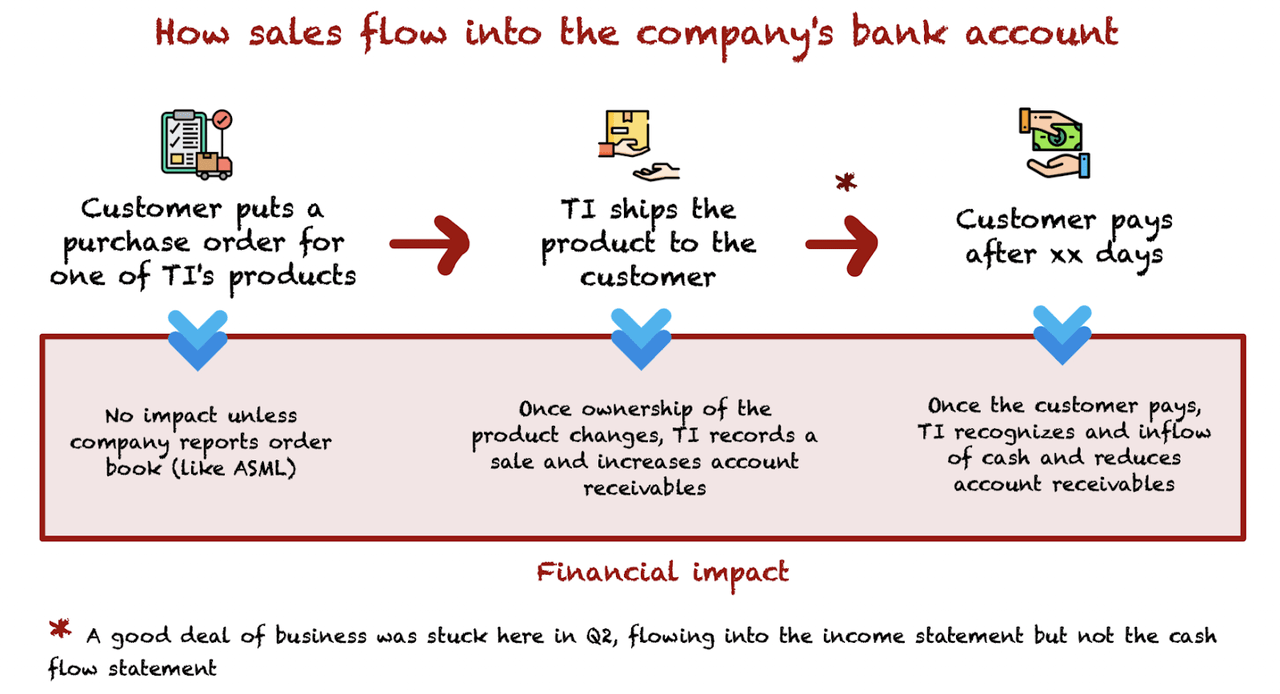

Account receivables measure the revenue that has been recognized but for which the money has not yet been received. Management claimed that a large chunk of orders came towards quarter-end, so revenue was recognized when the products changed ownership, but customers have yet to pay them (very few customers pay in advance or immediately after receiving their order).

Made by Best Anchor Stocks

This situation created a timing issue. While revenue was recognized in Q2, a significant portion of cash flow attributable to this revenue went into receivables and was “deferred” to Q3. Is it worrying? No, because this cash flow headwind should be a tailwind in the next quarter.

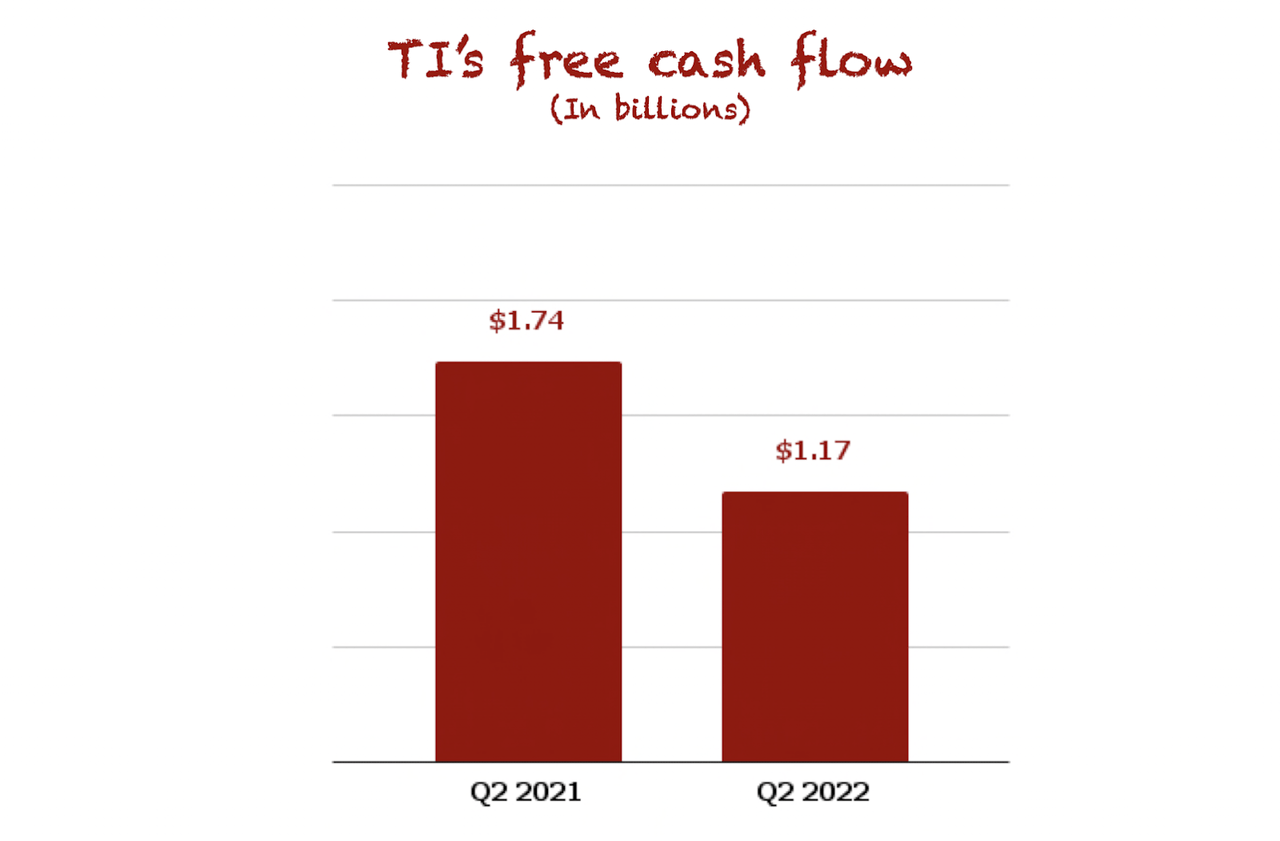

Free Cash Flow came in at $1.17 billion, a 32% decrease:

Made by Best Anchor Stocks

The decrease in FCF came from the decrease in Operating Cash Flow (which falls through) and also increased Capex. Capex increased 55% Y/Y to $597 million, but this was something to be expected as management already shared back in February that they would be ramping up Capex to build more capacity to support long-term growth.

Capex for the year should come in around $2.5 billion, but management expects $3.5 billion annually up until 2025. This means we should even expect Capex to increase in the coming years, albeit not linearly:

We talked about for the next four years, from 2020 to 2025 and average CapEx, that’s an average of $3.5 billion per year. For this year, it looks like we’re going to be coming in at about $2.5 billion, about as expected. It could come in a little higher than that. And then, obviously, since the average is $3.5 billion, you would expect the subsequent years to then come in higher than that number.

Source: Rafael Lizardi (TI CFO) during Q2 2022 Earnings Call

Despite lower cash flows, the company still managed to post a 22% FCF margin and a 34% OCF margin, which is pretty good. TI is a cash-generative company and is taking advantage of this to improve its financial position further. Cash and short-term investments ended the quarter at $8.4 billion, and the company retired $500 million of debt. Outstanding debt now stands at $7.3 billion with an average coupon of 2.7%.

The qualitative highlights

Management “doubles down” on share repurchases

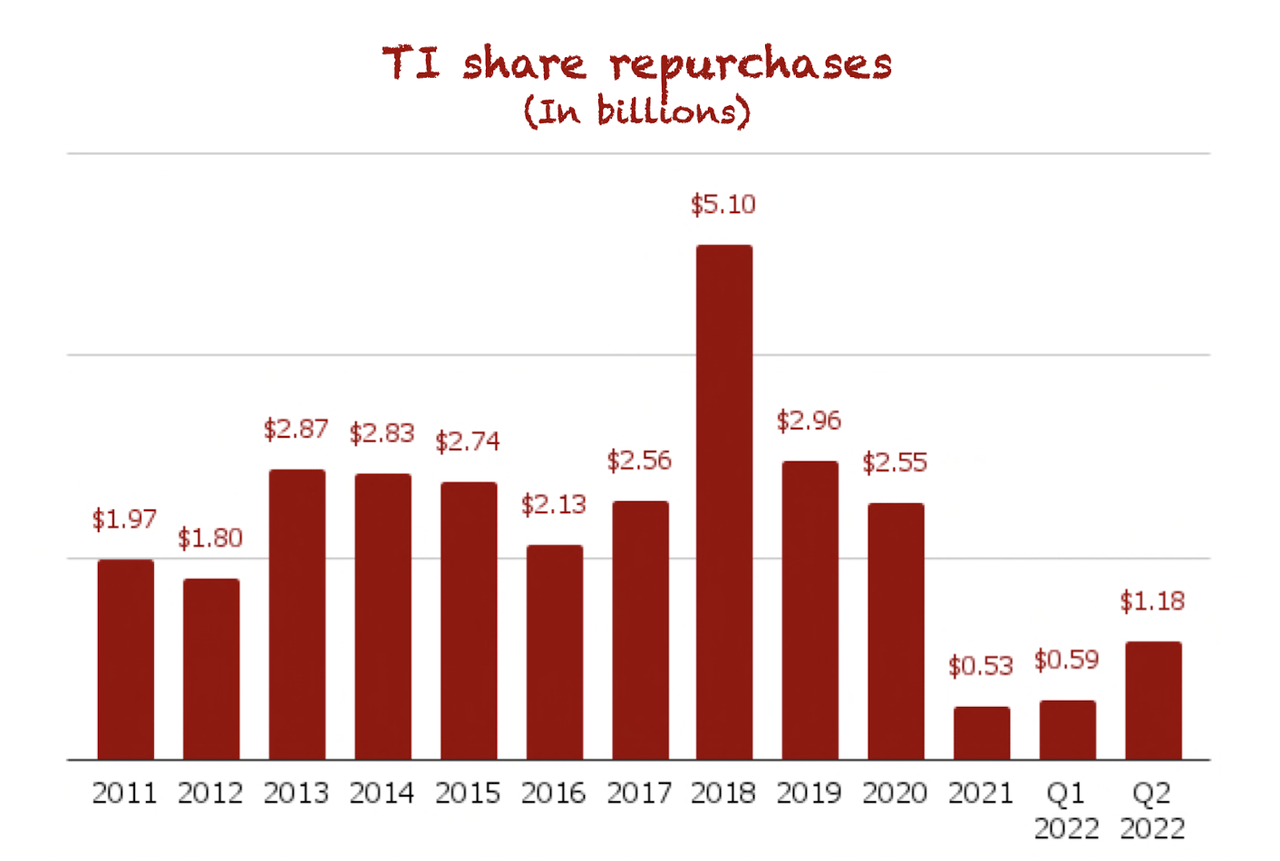

Management repurchased $1.2 billion in shares during the quarter. This might not seem relevant because repurchases don’t typically signal low valuations…unless you come across a management team that knows how to do them.

We can trust (not blindly) management when it comes to stock buybacks because they don’t typically repurchase stock when it lies above their estimate of intrinsic value:

The second-largest category has been share repurchases. Here, our objective is the accretive capture of future free cash flow for long-term owners. We focus on consistent repurchases when the present stock price is below the intrinsic value, using reasonable growth assumptions.

Source: Rafael Lizardi (TI CFO) during Capital Management Update

Another great characteristic is that the company’s repurchase program has no expiration date, something that’s not common on Wall Street. No expiration date makes total sense, though. Management has no idea when they will be able to use it, so it doesn’t make sense to put a cap.

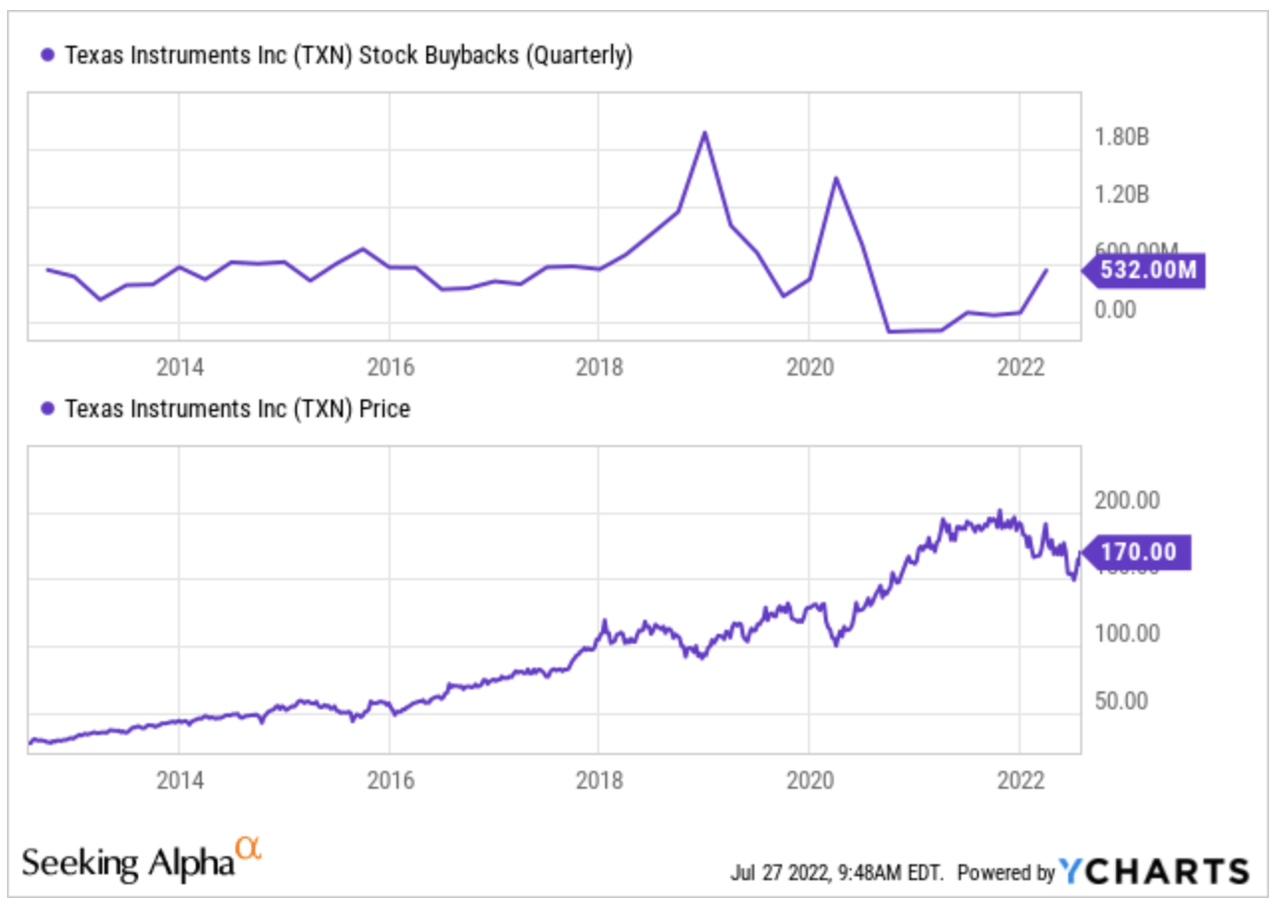

You simply have to look at the company’s history of repurchases to see how management built a reputation around buybacks. In 2021, the company repurchased just $527 million in stock as it was expensive. The situation was different in 2019 when the stock cratered, and management decided to spend significantly on buybacks.

The chart below perfectly represents what any investor would like to see when it comes to buybacks. Notice how they spike when there’s a significant drawdown in the price. It seems as if repurchases were made with the benefit of hindsight!

YCharts

After a relatively calm 2021, management turned the buyback machine back on in 2022. In Q1, management repurchased more than what they repurchased in the whole of 2021 and, in Q2, they doubled it:

Made by Best Anchor Stocks

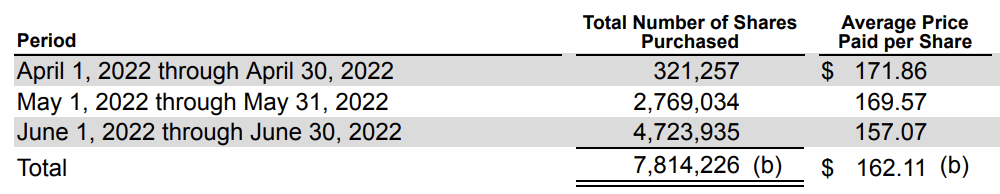

The average price paid for the shares this quarter was $162, with buybacks accelerating significantly below the $160 level:

Texas Instruments’ 10Q

It’s reassuring to know that this management with a great track record doesn’t think the stock is overvalued at the current levels. Remember that nobody has more information than they do.

Manufacturing capacity coming online

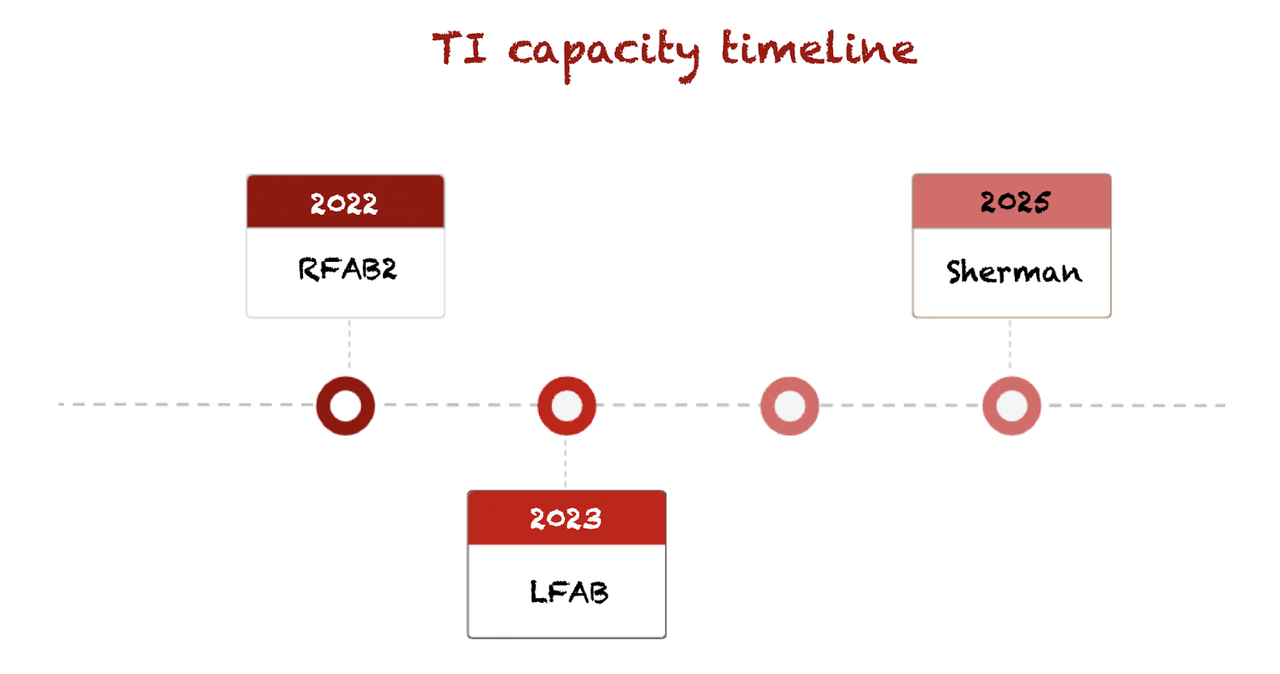

As we already mentioned, Texas Instruments is going through a significant Capex cycle to build additional capacity. Management knows that FCF/share growth will come from revenue growth in the future, and they need new facilities to support this growth. During the Q2 earnings call, management shared the capacity roadmap:

Made by Best Anchor Stocks

As you can see, we’ll still have to wait until full capacity is online, so it’s good that we are patient investors.

Supply flexibility is essential when you are diversified

An interesting (and essential) characteristic of Texas Instruments’ supply was discussed during the call. As we already mentioned, the company sees strength in some sectors and weakness in others. So, can the company shift supply to where demand is strong? The answer is yes, it can:

The capacity is relatively fungible. There’s always some nooks and crannies that are a little different for each technology or each particular part. So but at the highest level, yes. We have been adjusting our capacity over the last two months to the best uses and support our long-term strategic roadmap.

Source: Rafael Lizardi (TI CFO) during Q2 2022 Earnings Call

This is great because if it wasn’t the case, the company might be missing sales in some segments where growth is booming while suffering overcapacity in others. All in all, a rigid supply would make the company less efficient. But that’s clearly not the case.

Guidance: The focus

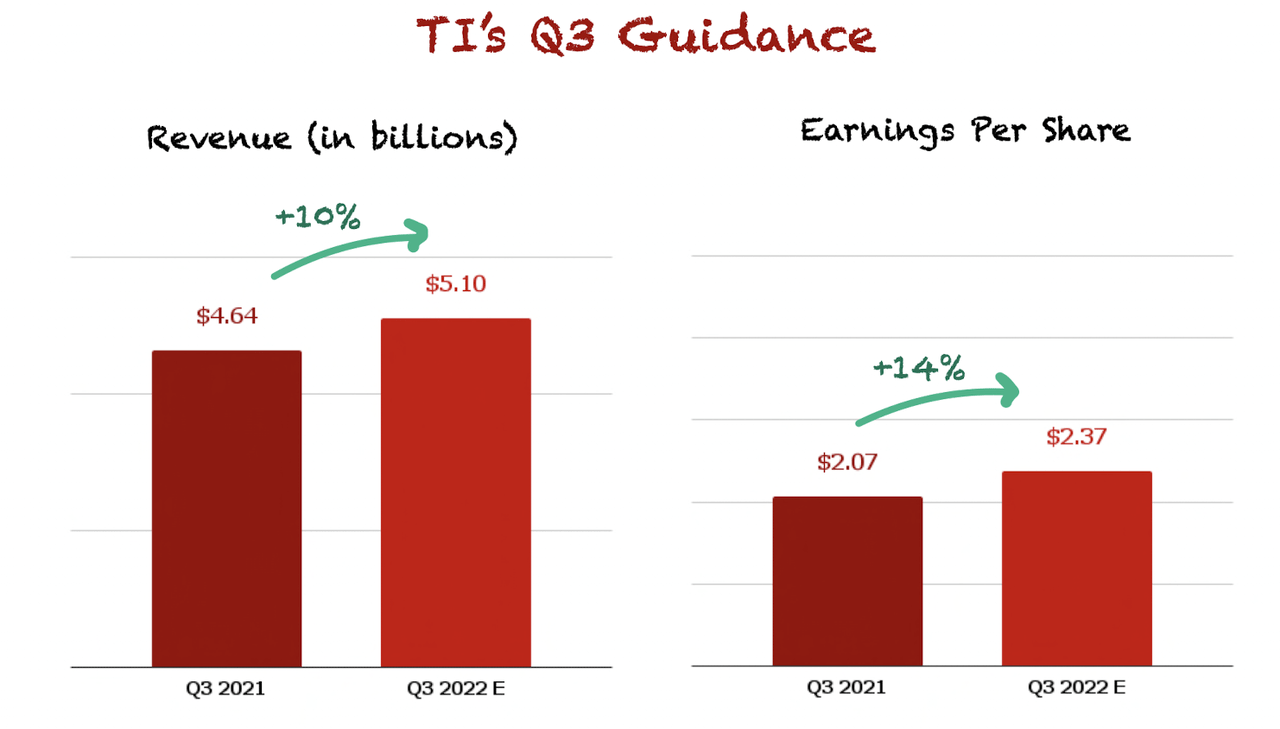

With a technical recession confirmed yesterday and a hypothetical semiconductor bust around the corner, guidance is the focus for many investors. Q2 results for Texas Instruments were solid, and Q3 guidance was also pretty strong.

Q3 guidance

For Q3, management guided for revenue between $4.9 and $5.3 billion (+10% YOY at the midpoint) and EPS between $2.23 and $2.51 (+14% YOY at the midpoint):

Made by Best Anchor Stocks

Management doesn’t guide cash flows, but we should expect them to come significantly stronger in Q3 when accounts receivable flow into the cash flow statement, as previously discussed.

The guide came once again above analysts’ expectations, who were guiding for $4.95 billion in revenue and EPS of $2.25.

An important thing to note is that this guidance doesn’t factor in the Chips Act which has been recently passed and just needs to be signed by Joe Biden. At the moment of giving guidance, the bill was not yet passed so management didn’t factor it in. Texas Instruments should benefit strongly from it, though:

The numbers that we have given you over the last six months or prior did not include any benefit from any of those bills. On the Chips Act specifically, is great to see strong bipartisan support of U.S. semiconductor manufacturing that will boost domestic chip production and improve the industry’s ability to remain competitive. This provision will be meaningful and support our manufacturing roadmap.

Source: Rafael Lizardi (TI CFO) during Q2 2022 Earnings Call

TI doesn’t provide yearly guidance.

Conclusion

All in all, it was a great quarter by Texas Instruments, and we think this image is simply beautiful and shows the excellent execution of the company:

Twitter: Consensus Gurus

Management’s does a great job and the secular tailwind seems to continue to help the company weather a challenging environment.

In the meantime, keep growing!